Financial leverage plays a crucial role in corporate finance and investing. The gearing formula helps assess a company’s financial risk by measuring the proportion of debt relative to equity. Investors, analysts with metatrader 5 , and business owners use this ratio to determine a company’s financial health and its ability to meet long-term obligations.

Understanding how to calculate gearing and interpret its implications can help traders and investors make informed decisions. This guide breaks down the gearing formula, its variations, and how to apply it in financial analysis.

Gearing Formula Explained

Gearing ratios provide insight into how a company funds its operations—whether through debt, equity, or a mix of both. A high gearing ratio indicates significant reliance on borrowed capital, which can magnify returns but also increase financial risk.

Definition and Purpose

The gearing formula measures a company’s level of financial leverage. It highlights the proportion of debt compared to equity, showing how much of a company’s capital structure depends on borrowed funds.

Companies with higher gearing are more sensitive to economic downturns, as they have higher interest obligations. On the other hand, firms with lower gearing rely more on shareholder equity, which may limit growth potential but provides greater financial stability.

Role in Financial Analysis

Investors use gearing ratios to assess risk before investing in a company. A high gearing ratio may indicate potential cash flow issues, making the firm vulnerable to rising interest rates or declining revenue.

Creditors also examine gearing when determining a company’s ability to meet debt repayments. If gearing is too high, lenders may hesitate to provide additional financing. Conversely, a low gearing ratio suggests conservative financial management, which may be preferable in volatile industries.

Gearing Ratio Formulas

Several gearing ratio formulas exist, each offering a different perspective on financial leverage. The most common include the debt-to-equity ratio, debt ratio, and equity ratio.

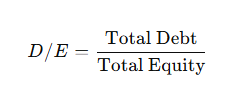

Debt-to-Equity Ratio

The debt-to-equity ratio (D/E) shows how much a company relies on borrowed funds compared to shareholder investments. A higher ratio means the company uses more debt to finance its operations than equity. This can amplify returns when business is strong but also increases financial risk, especially if revenue declines.

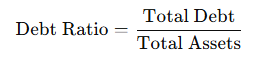

Debt Ratio

The debt ratio indicates what portion of a company’s total assets is funded by debt. A higher percentage suggests the business is more dependent on borrowed money, which can lead to financial strain if earnings drop. A lower percentage means the company finances most of its assets through its own capital, reducing risk but potentially limiting growth opportunities.

Equity Ratio

The equity ratio measures how much of a company’s assets are funded by shareholder investments rather than debt. A higher percentage signals financial stability, as the company is less dependent on external lenders. A lower percentage suggests greater reliance on borrowing, which may increase financial vulnerability during economic downturns.

How to Calculate the Gearing Formula

Accurately calculating the gearing ratio requires a clear understanding of financial statements, particularly the balance sheet, which provides details on total debt, equity, and assets.

Step-by-Step Calculation

- Identify total debt – Include both short-term and long-term debt from the balance sheet.

- Determine total equity – Sum up shareholder capital and retained earnings.

- Apply the chosen gearing formula – Use the debt-to-equity ratio, debt ratio, or equity ratio based on the required analysis.

- Interpret the result – Compare the ratio to industry benchmarks to assess financial health.

Example Calculation for Businesses

Consider Company A, which has the following financials:

- Total debt: $500 million

- Total equity: $250 million

- Total assets: $800 million

Using the debt-to-equity ratio formula:

A D/E ratio of 2.0 indicates that the company has twice as much debt as equity, suggesting higher financial leverage.

For the debt ratio:

This means 62.5% of the company’s assets are financed through debt, highlighting a significant reliance on external financing.

High vs Low Gearing Ratios

Understanding whether a gearing ratio is high or low depends on industry standards, business models, and market conditions.

Risks and Benefits of High Gearing

Advantages:

- Higher returns on equity – Borrowing can enhance profits when returns exceed interest costs.

- Tax benefits – Interest expenses are often tax-deductible, reducing taxable income.

- Expansion opportunities – Debt financing allows companies to invest in growth without diluting shareholder control.

Risks:

- Increased financial risk – High debt obligations can become unmanageable during downturns.

- Rising interest costs – Interest rate hikes can strain cash flow.

- Lower investor confidence – High gearing can signal financial instability, deterring potential investors.

Stability and Growth in Low Gearing

Advantages:

- Financial stability – Less reliance on debt reduces financial vulnerability.

- Lower interest expenses – Companies save on financing costs, improving profitability.

- Higher creditworthiness – Lenders and investors view low-geared firms as lower risk.

Disadvantages:

- Limited growth potential – Without leveraging debt, expansion opportunities may be restricted.

- Lower returns on equity – Excessive conservatism in capital structure can reduce potential profits.

Evaluating a Good and Bad Gearing Ratio

The suitability of a gearing ratio depends on industry norms, company structure, and market conditions. While a higher ratio indicates greater leverage, it doesn’t always signify financial distress. Conversely, a low gearing ratio might suggest missed growth opportunities.

Industry Standards and Benchmarks

Different industries operate with varying levels of acceptable financial leverage. Capital-intensive sectors, such as real estate and utilities, typically maintain higher gearing ratios due to their reliance on long-term debt for expansion. In contrast, technology and service-based industries often function with lower debt levels, prioritizing equity financing.

Industry gearing benchmarks:

| Industry | Typical Gearing Ratio Range |

| Utilities | 50% – 70% |

| Real Estate | 40% – 60% |

| Manufacturing | 30% – 50% |

| Technology | 10% – 30% |

| Retail | 20% – 40% |

Comparing a company’s gearing ratio to industry benchmarks helps determine whether its debt level is excessive or within a sustainable range.

Factors Influencing an Optimal Ratio

A company’s ideal gearing ratio is influenced by:

- Cash Flow Stability: Firms with consistent revenue streams can support higher debt levels.

- Interest Rate Environment: Rising rates increase borrowing costs, making high gearing riskier.

- Business Lifecycle: Startups may rely more on equity, while mature companies may leverage debt for expansion.

- Economic Conditions: Economic downturns amplify risks for highly leveraged firms.

Investors assess these factors alongside a company’s gearing ratio to determine its financial health and resilience.

Gearing Formula and Financial Risk

A company’s gearing ratio directly affects its risk exposure, influencing both solvency and investor confidence.

Impact on Business Solvency

High gearing increases fixed obligations in the form of interest payments, reducing financial flexibility. If revenue declines, highly geared companies may struggle to meet debt commitments, leading to potential insolvency.

Key risks associated with high gearing include:

- Reduced Liquidity: A large portion of cash flow is directed toward debt servicing.

- Increased Default Risk: Higher leverage amplifies the risk of missing debt payments.

- Lower Credit Ratings: Credit agencies may downgrade firms with excessive gearing, raising borrowing costs.

Companies with sustainable gearing levels maintain solvency by ensuring their earnings cover interest expenses comfortably, often measured using the interest coverage ratio:

Interest Coverage Ratio=EBITInterest Expense\text{Interest Coverage Ratio} = \frac{\text{EBIT}}{\text{Interest Expense}}Interest Coverage Ratio=Interest ExpenseEBIT

A ratio below 1.5 indicates financial strain, while a ratio above 3 suggests strong debt coverage.

Investor Perspective on Gearing

Investors analyze gearing ratios to assess risk-adjusted returns. A moderate level of gearing can enhance returns, as debt financing enables expansion without diluting shareholder ownership. However, excessive leverage introduces financial instability.

How investors interpret gearing ratios:

- Low Gearing: Stability, lower risk, but potentially slower growth.

- Moderate Gearing: Balanced risk-return profile, ideal for long-term growth.

- High Gearing: Potentially higher returns, but with increased volatility and risk.

Dividend investors may prefer lower-geared companies with predictable earnings, while growth-focused investors may tolerate higher leverage for aggressive expansion strategies.

Strategies for Managing Gearing Ratio

Companies can actively manage their gearing levels to maintain financial stability and investor confidence.

Reducing Excessive Leverage

When a company’s gearing ratio is too high, it can take measures to lower its dependence on debt:

- Debt Repayment: Allocating excess cash flow toward reducing outstanding liabilities.

- Equity Financing: Issuing new shares to raise capital instead of borrowing.

- Asset Sales: Selling non-core assets to generate funds for debt reduction.

- Refinancing Debt: Negotiating lower interest rates or extending loan maturities to ease financial pressure.

Reducing gearing improves creditworthiness, lowering the cost of future borrowing.

Maintaining an Optimal Balance

Sustainable gearing ensures a company leverages debt strategically without overexposure. Best practices include:

- Aligning Debt with Cash Flow: Ensuring debt servicing aligns with revenue generation cycles.

- Diversifying Financing Sources: Balancing debt and equity financing to optimize capital structure.

- Hedging Against Interest Rate Risks: Using fixed-rate debt or financial instruments to mitigate rate fluctuations.

By maintaining a healthy gearing ratio, companies can fund growth initiatives while safeguarding financial stability.

Practical Applications of the Gearing Formula

Gearing ratios play a crucial role in financial decision-making for businesses, investors, and creditors.

Corporate Decision-Making

Executives rely on gearing ratios to assess financing options, expansion plans, and risk management strategies. A company considering new projects evaluates whether to finance through debt or equity by analyzing its current gearing level.

Example: A manufacturing company planning a $50 million expansion must decide whether to issue bonds or raise capital through equity. If its gearing ratio is already high, increasing debt may strain cash flow, making equity financing the preferable option.

Assessing Investment Opportunities

Investors incorporate gearing ratios into their due diligence process when evaluating stocks, bonds, or corporate bonds. A company with a gearing ratio significantly above industry norms may indicate financial distress, while a company with a stable ratio suggests disciplined financial management.

For bond investors, a company’s gearing level affects its credit risk. Higher gearing means greater default risk, requiring higher yields to compensate for potential volatility.

Importance of Gearing Ratios in Financial Analysis

Gearing ratios provide critical insights into a company’s financial structure, helping investors, analysts, and lenders assess risk and stability. A well-balanced ratio can indicate a company’s ability to leverage debt for growth, while excessive gearing may signal financial distress.

How Investors Use Gearing Data

Investors analyze gearing ratios to evaluate risk exposure and capital efficiency. A moderate level of gearing suggests a company is using debt effectively to generate returns, whereas excessive debt reliance may indicate potential cash flow issues.

Ways investors apply gearing data:

- Stock selection: Companies with stable gearing ratios are often seen as lower-risk investments.

- Dividend sustainability: Highly geared firms may struggle to maintain consistent dividend payouts.

- Valuation assessment: A firm with high gearing but strong earnings growth may still be a solid investment, depending on debt servicing capacity.

Traders and institutional investors also consider gearing when identifying value stocks versus growth stocks, as leverage levels impact earnings predictability and volatility.

Relevance to Credit Ratings and Lending

Lenders and credit rating agencies use gearing ratios to assess a company’s ability to meet debt obligations. A high gearing ratio may lead to a downgraded credit rating, increasing borrowing costs and limiting future access to financing.

Key impacts on lending decisions:

- Higher gearing = higher borrowing costs – Lenders charge higher interest rates to companies with greater debt exposure.

- Low gearing = better loan terms – Firms with lower leverage often receive more favorable credit terms.

- Debt covenants: Some lenders impose restrictions on gearing ratios, requiring companies to maintain certain levels to secure financing.

Understanding a company’s gearing ratio helps stakeholders gauge financial resilience, especially in volatile market conditions.

Common Misconceptions About Gearing Ratios

Despite their importance, gearing ratios are often misunderstood. Investors and analysts must separate myths from facts to make informed decisions.

Myths About High Gearing

A high gearing ratio is not inherently bad, nor does it always indicate financial trouble. Some misconceptions include:

- “High gearing means a company is at risk of bankruptcy.” While excessive debt can be risky, companies with stable cash flows can sustain higher gearing without issues.

- “Companies should always aim for low gearing.” In capital-intensive industries, debt financing is necessary for growth, and low gearing may indicate underutilized financial opportunities.

- “A high gearing ratio always signals financial distress.” Some firms strategically maintain higher gearing to optimize tax efficiency and maximize shareholder returns.

Investors should assess industry context, earnings stability, and debt servicing capacity before drawing conclusions about a company’s leverage.

Misinterpretations in Financial Reports

Gearing ratios can sometimes be misleading if analyzed in isolation or without proper context. Common pitfalls include:

- Ignoring cash flow strength: A company with high gearing but strong operating cash flow may not be at risk, as it can easily cover interest expenses.

- Comparing across industries: A 60% gearing ratio in real estate may be normal, but in tech, it could signal excessive risk.

- Focusing on total debt without assessing maturity profiles: Short-term versus long-term debt structures matter. A company may have high gearing but manageable long-term debt repayments.

Proper interpretation of gearing ratios requires a comprehensive financial assessment, rather than relying on single-metric evaluations.

Frequently Asked Questions

Gearing ratios are a fundamental aspect of financial analysis, yet investors often have questions about how they fluctuate and impact investment decisions.

Can a company’s gearing ratio fluctuate?

Yes, a company’s gearing ratio can change over time due to:

- Debt repayment or new borrowing – Issuing new debt increases gearing, while repayments lower it.

- Equity issuance or buybacks – Raising capital through equity reduces gearing, while share buybacks increase it.

- Earnings fluctuations – A decline in profits may increase perceived gearing risk, even if debt levels remain unchanged.

Seasonal industries or cyclical businesses often experience gearing fluctuations based on revenue cycles and investment needs.

How does a high gearing ratio affect stock prices?

A high gearing ratio can influence stock performance in several ways:

- Higher risk perception – Investors may demand a higher risk premium, impacting stock valuation.

- Earnings volatility – Leverage magnifies earnings fluctuations, increasing stock price swings.

- Dividend stability concerns – Highly leveraged companies may cut dividends to manage debt obligations, affecting investor sentiment.

However, in strong market conditions, companies with high gearing may outperform due to amplified returns, making them attractive to risk-tolerant investors.

Why do different industries have different optimal ratios?

Optimal gearing ratios vary by sector due to differences in capital requirements, revenue stability, and financing models.

| Industry | Typical Gearing Range | Reason |

| Real Estate | 40% – 70% | Heavy reliance on debt for property acquisitions |

| Utilities | 50% – 75% | Stable cash flows support higher debt loads |

| Manufacturing | 30% – 50% | Moderate capital investment needs |

| Technology | 10% – 30% | Low reliance on debt, high equity funding |

| Consumer Goods | 20% – 40% | Mix of equity and debt financing |

Industries with predictable cash flows (e.g., utilities) can sustain higher gearing, whereas sectors with high revenue variability (e.g., tech) often rely more on equity financing.